(The CBP Form 7553 must be submitted to CBP 5 working days prior to exportation, or 7 working days prior to destruction). Substitution is allowed if both the imported and substituted merchandise are classified under the same 8-digit HTS, provided the imported merchandise 8-digit HTS is not described as “other.” If the imported merchandise 8-digit HTS is described as “other,” substitution is allowed if both the import and substituted merchandise 10-digit classification is the same and not described as “other.” The exported/destroyed merchandise may be substituted merchandise that is classified under the same 8-digit HTS as the imported merchandise and has not been used in the U.S. Substitution unused merchandise drawback (1313(j)(2)) The CBP Form 7553 must be submitted to CBP 5 working days prior to exportation, or 7 working days prior to destruction. Export/destroyed merchandise must be the same article that was imported into the U.S. Unused merchandise drawback (1313(j)(1)) - Imported merchandise that has not been used in the U.S., or has undergone an operation(s) or combination of operations that does not amount to a manufactured or produced article, as provided under the provisions of the manufacturing drawback law. Time requirements for the different types of drawback are provided below: This form is a required document that must be provided to CBP within 24 hours of the filing of the drawback claim in order to fulfill the complete claim requirements (if the claimant does not have one-time waiver (OTW) or waiver of prior notice (WPN) privileges). After this form is returned by CBP, it should be uploaded as an attachment to the company's drawback claim in Digital Image System (DIS), along with proof of exportation or destruction, and submitted for acceptance in Automated Commercial Environment (ACE). The form will be returned to the company, indicating CBP's decisions on examination, destruction or waiver (indicating that CBP has made a determination not to examine the merchandise prior to export or witness the destruction). This form must be presented to CBP prior to any action taken by the company regarding exportation or destruction. Please note that this form must be submitted to the CBP Officers at the port of examination, which for exported merchandise is usually the port of export, and for destructions, usually the port where the merchandise is located.

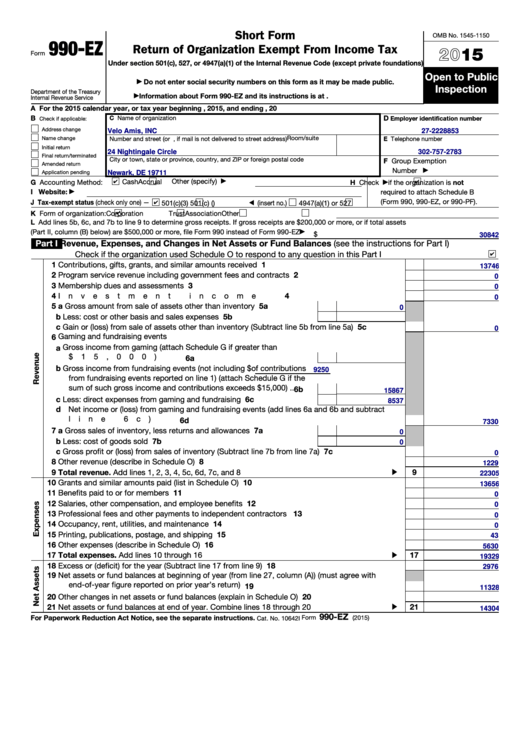

FREE 2015 TAX SOFTWARE WITH SCHEDUAL C UPDATE

If you do not have an assigned client representative, send an email to guidance related to drawback claim transmission, please reference the following links:ĭirect questions regarding this update to Form 7553 Please reach out to your assigned CBP client representative for more information. Note that this process will take 3-6 months to complete. There is more information about this process at the following link: Transmitting Data CBP Electronic Data Interchange. Establish your own communications connection to the CBP Data Center in order to self-file your claims.See this link for a list of service bureaus and other certified ABI software vendors: ABI Software Vendors List Self-file your claims through a service bureau, which provides both the software and the communications connection to the CBP Data Center.Hire a licensed customs broker to file a claim on your behalf: Find a Broker by Port.

122).Ĭompanies/individuals that are not automated have several options for filing electronic drawback claims: All drawback claims must be filed electronically in ACE and in accordance with the Trade Facilitation Trade Enforcement Act of 2015 (TFTEA) (Pub. Cargo Systems Messaging Service Webpage UpdateĪfter February 22, 2019, paper drawback claims are no longer accepted. CSMS #45782283 - Retail Sales Programming Issue: Interim Solution for Drawback Exports to Canada and MexicoĬertain Cargo Systems Messaging Service correspondence (e.g., 12-000546 and 13-000476) may be of some assistance to those participating in drawback.CSMS #45101783 - Issue with Certain ACS Archived Import Entries on Drawback Claims has been Resolved.CSMS #44097386 - Troubleshooting Drawback Revenue Errors.CSMS#41529100- Drawback Claim Issues with Trade Remedies HTS Numbers (Chapter 99 Numbers).

0 kommentar(er)

0 kommentar(er)